Watch out for the aussie

Written by A Forex View From Afar on Friday, June 27, 2008Back to www.thelfb-forex.com

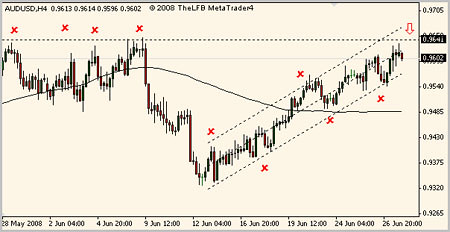

The aud/usd has been advancing for more than two weeks, but things may change as we had into the 0.9650 resistance.

The last time the pair reached this area it spent days (weeks actually) trying to break higher, but just couldn’t pull off the move. The 0.9650 level showed a wall of short orders hitting the market, all at the same time.

Thinking that the pair pays a huge swap interest rate, theoretically more then the gbp/yen does, the pair should have been used for the carry trade and have broken higher without any problems. Well, it did not do that and by the magnitude of the short orders in the 0.9650 area, something tells me that a major player was selling. The RBA maybe?

The pair is once again approaching the same level, and again volatility can be expected as traders ask canit break and bounce higher? For me, the short side seems to be more likely.

As seen in the above chart, the 0.9650 level is the get-together point for two pretty important resistances. In that area, the aussie will meet the 0.9650 resistance together with the upper line of the channel in which the pair traded recently. If we keep our eyes on the recent history, the pair needs very strong momentum to move higher, and withput a major player hitting the market with short orders, it is unlikely that it will find the required strength to advance any further.

On Tuesday night, the RBA is scheduled to release their interest rate decision. The market expects the central bank to hold, but at the same time a dovish tone is expected since the recent economic releases point out that the last rate hikes have already sterted to impact the real economy. If we add the recent trend spotted when a major CB release their interest rate decision, buy the rumor sell the news, we obtain one more proof that a turn around may be on the cards.

One further argument comes to mind. This week, especially the last trading days, were clearly awful for any dollar bull, and an observation is that usually trends end with the week-end break, the time when traders cash their chips and enjoy some days off (right). This leads to to believe that short aussie, after a failed upside test from these levels is what we will be seeing.

The above is my personal breakdown for the week ahead, my little aussie analysis. The only thing left is the market to prove me right, again!

| Posted in »

| Posted in »

0 comments: Responses to “ Watch out for the aussie ”