A look over the NFP release

Written by A Forex View From Afar on Saturday, June 07, 2008Back to www.thelfb.com

The NFP release sent markets into selling frenzy. US Equities fell more then 3%, with the Dow Jones shredding 394 points, and S&P 43 points lower. The mighty dollar lost 200 pips against the euro, whereas the dollar index lost 0.70 points. Most important maybe was that Oil reached $139.12 a barrel, making a new historical high, and breaking the record of the biggest gain in one trading session, of $10.

To appreciate the magnitude, ten years ago Oil was trading at $10 a barrel, while today Oil gained that much in only one trading session.

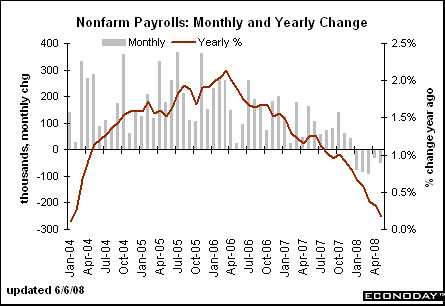

Back to the NFP, the employment sector marked the fifth consecutive month of declines, while the unemployment number jumped to 5.5%, the biggest increase in 22 years.

The Non Farm Payroll was released at -49K, better then market expectations of -57k. Taking out the jobs added by the infamous Death/Birth (D/B) model, the NFP release number would have printed at -266k. There were 217k jobs added by D/B, from which

• 42k were added in the construction sector, the same sector which in the last 2 months broke every record, but in a negative way;

• 9k for the financial sector, were everyone is announcing huge lay-offs;

• 77k new jobs for the Leisure and Hospitality sector, were most parts of the industry are having hard times finding any tourist, offering deep discounts.

The biggest gained to the unemployment number came from the teenagers, which jumped 3.3% from one month earlier, while adult male unemployment rose 0.3%, with women 0.5%.

I don’t think the negative number was big surprise for anyone, nor that the big jump in unemployment was something unexpected, not to say that it was caused by teenagers taking the summer break earlier. What caused the reductions in most terms were the dollar depreciation and some geo-political comments.

The NFP release practically tore apart the possibility of a rate increase in the following FOMC meeting, but at the same time on the other side of the pond the ECB were announcing their intentions to hike. If we add that Shaul Mofaz , Israel's transportation minister and a contender for the post of prime minister, said Israel will have to attack Iran, the commodity market had all the required ingredients to skyrocket Oil prices. Oil at $138, the settlement price, made equity trader's knees shake under the table, and sent the major US Indexes lower.

| Posted in »

| Posted in »

0 comments: Responses to “ A look over the NFP release ”