Stagflation is next

Written by A Forex View From Afar on Monday, June 23, 2008Back to www.thelfb.com

When a country does not have growth is called slowdown or slump, when a country has rising prices its called inflation, but when a country shares them both its called stagflation.

Some voices have started to indicate that the next thing to come is stagflation, inflation linked with no growth. All all the cycles that a country goes into, stagflation is the worst, and the answer is very simple: to fight inflation properly high interest rates are needed, but high interest rates kill growth in the economy, that is the point of it. To fight a slowdown, monetary policy can be used to cut the interest rates, but then inflation will increase at a very fast pace. So basically, the Central Bank is between the hammer and the anvil, not being able to move easily in any direction.

Inflation expectations are very high on both sides of the Atlantic and at the same time the whole world is sharing this view. The other common thing shared on both sides of the pond is a visible slowdown.

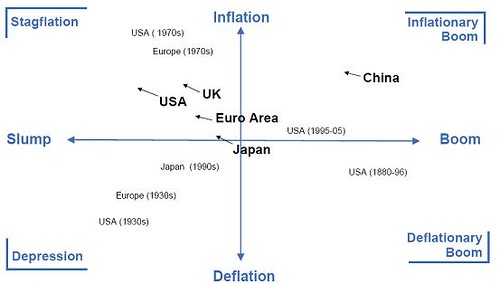

We could very easy say, and this may surprise many, that at this time the Euro-area, UK, Japan and US are all in a stagflation period or very close to going into one. If future inflation and growth estimates come true, stagflation will be here. Morgan Stanley reveal charts showing each major economy, and in what cycles is currently in. Guess what, all of the major economies are heading to stagflation and the only improvements from a 70s like period are the developments in the monetary policy arena and the financial markets, to keep us far enough away from a prolonged period like that. At least Japan seems to be making a big step forward from deflation to inflation. Good job BoJ, you only needed 18 years for that to happen.

From my point of view, if the above scenario comes true, it will be a battle between the central bank’s monetary objectives. On one side there will be the “inflation-fighters” while on the other the “assuring growth and stable prices” central bank. Well, the ECB and the Fed can’t move too much, although on the longer term (2-3 years) something tells me the ECB will raise more then the Fed does. Stagflation is not something an equity trader would want to see, so probably the yen will strengthen to some extant. Next week, TheLFB Analysis Team will release the outlook for the second half of 2008, so stay tuned.

My last thought for today’s analysis: the Fed will keep the Fed Funds on hold for the next meetings, but at the same time hawkish comments will come from the Fed members (sounding like the ECB a couple of months ago). These comments will lead to a stronger dollar in my view, something the Euro-area will certainly like to see.

| Posted in »

| Posted in »

0 comments: Responses to “ Stagflation is next ”