The need for a bailout

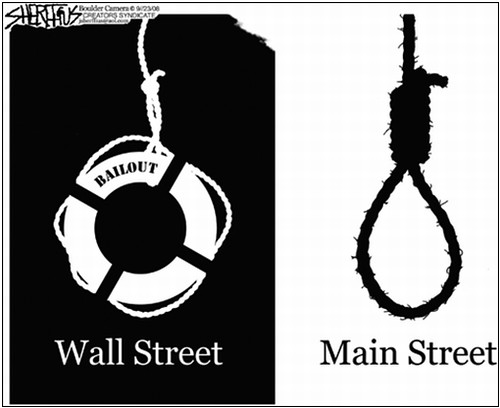

Written by A Forex View From Afar on Tuesday, September 30, 2008The House of Representatives might have vetoed the Treasury’s plan to bailout financial institutions, but the market still sees a very strong need for a rescue package.

The market’s response as the news of the vote unwrapped, confirms that investor’s confidence is close to zero. Global equity markets tumbled the most in 21 years, while the major U.S. indexes posted some record declines.

If someone wants to look for any further evidence that the financial system needs a serious bailout plan, then just look at the number of banks recently bankrupted or were forced to “sell themselves” on both sides of the pond. Lehman, Merrill, AIG, Washington Mutual, Wachovia in the U.S and Fortis, Dexia and Hypo Real Estate in Europe are just the latest banks that can be added to the of credit crunch casualty list.

A new bailout plan with explanation and serious clarification on what the Treasury will do with the cash it receives might give it the potential it needs to pass the vote. However, till then, who can vote for a blank check with $700 billion on it that not too many know its clear purpose or effects?

Reports are just starting to appear with the effects of the credit-crunch over the real economy. Tougher access to liquidity and credit, weak consumption and small owners complaining about the business environment are just to name a few. If banks will not start to do what they are intended to do, lend, then this will be just the beginning as the whole economy is torn apart.

An alternative to the bailout plan would be for the Treasury to bankrupt every possible bank, until only one stands. Since Mr. Paulson has strong relationships with Goldman Sachs, it will not be hard to imagine which would be the last one standing. Moreover, since now they receive deposits, who really needs more than one bank??? Oh, let’s not forget that the U.S. still needs Bank of China to support its debt, but that would be another story.

To finish this article, who knows what a Wall Street bank is now? The answer is simple: a bank is nothing more than a future government entity.

| Posted in »

| Posted in »