Written by A Forex View From Afar on Monday, July 07, 2008

Back to www.thelfb-forex.com

Today, the Federal Reserve Bank of San Francisco President Janet Yellen laid a gloomy outlook for the coming months in a speech at the University of California San Diego’s Economics Roundtable.

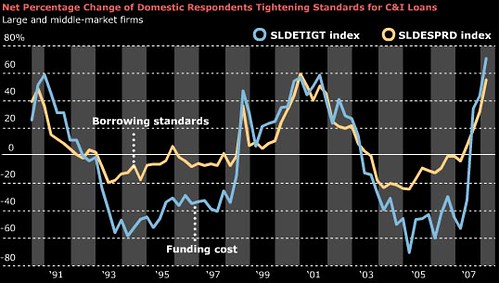

Mr. Janet Yellen said credit conditions are still tight, despite the Fed’s more than 300 basis points cut. Inflation expectations are still anchored, despite the fact that she expects inflationary pressures to persist as a problem in the coming months.

Speaking about the housing market, the current problems will continue throughout 2009 as residences in some areas can still be considered too expensive in the current lending climate.

Well, until now she didn’t say anything new, I just do not know from where she took the “inflation expectations as reasonably well anchored” part, when you have the CPI running at over 4%. Probably because she is the one who will have to keep inflation expectations tight and at the same time assure us that the CPI will not get too high. It seems that the Fed partially failed in fulfilling its mandate.

What I really liked in her speech is she admitted that “a few months of data don’t make a trend, particularly because we can’t be sure how large the effects of the roughly $100 billion temporary tax rebate program have been.” Now, if even a Fed member is not sure how much of an impact the free $600 had, than who should. Those analysts who modify their forecast every few months? To me, it’s quite strange to hear something like this from a person who sets the monetary policy.

Furthermore, having the Fed not sure what are the rebate’s effects over the real economy, we could have a plausible explanation why there was such a drastic change in monetary policy lately; from cutting rates inter-meeting, straight away then going to a 'wait and see policy'.

These put together, reassures me that the Fed will stay on hold for the time being, not moving the Fed Funds anywhere and only jawboning about inflation, which in turn should empower the dollar. So, compared to the currency on the other side of that trade you are just about to take, does the dollar look that weak any more? Unlike most regions right now, there is no chance of a cut coming from the Fed it seems, the euro, pound, aussie and yen may want to keep an eye on the market's feel of their fair value.

| Posted in »

| Posted in »