A Fud Funds Futures Story

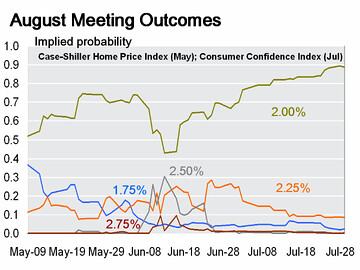

Written by A Forex View From Afar on Wednesday, July 30, 2008Fed Funds Futures contracts are pricing a hold on overnight interest rates for the next meeting outcome, scheduled for 5th August.

If the Fed do hold, as the market expects, it will be the second FOMC meeting at which rates are kept at 2%. This after the Fed cut at the April meeting by 25 basis points. According to the Cleveland rate probability the market sees a 90% chance of a hold on Fed Funds next Tuesday.

Regarding future expectations, Fed Funds Futures are pricing a rate increase for the December settlement date. This outlook has the potential to influence the dollar’s valuation, especially if we add the data from the latest period, which suggest the US economy had found a bottom. The old greenback may be further empowered by the fact that the Eonia future contracts in Europe are starting slowly to move up, reflecting the market view that the ECB will likely hold rather than raise.

As such, the dollar bulls may overcome the market for the time being. However, these futures expectations may alter quickly once one of the central banks steps again in the market to do some more jawboning, keep your eye on the calendar; they tend to sneak these speeches in under the radar. Outside of hot air it does look as though the euro has some work to do to hold current valuations, and that makes 1.5550 a very pivotal area to work up or down from.

| Posted in »

| Posted in »

0 comments: Responses to “ A Fud Funds Futures Story ”